Press Release

Illegal Operator Alert – GVEST GLOBAL /GVEST (ALAUSA) COOPERATIVE MULTIPURPOSE LIMITED/GVEST INVESTMENT LIMITED/GTEXT HOLDINGS

20/08/2025The attention of the Securities and Exchange Commission (The Commission) has been drawn to the activities of GVEST GLOBAL, which holds itself out as an Investment Adviser/Fund Manager promoting unregistered investment schemes. The company Gvest Global is also known and operate under the following names: GVEST (ALAUSA) COOPERATIVE MULTIPURPOSE LIMITED GVEST INVESTMENT LIMITED GTEXT HOLDINGS […]

Illegal Operator Alert – Pocket Option

21/07/2025The attention of the Securities and Exchange Commission (the Commission) has been drawn to the activities of POCKET OPTION, an online investment Platform, which presents itself as an Investment Adviser/Fund Manager promoting unregistered investment scheme. Investigations reveal that POCKET OPTION has been actively promoted on social media platforms and online forums. Its operations exhibit the typical […]

Circular To All Prospective Capital Market Operators On Pre-Registration Training And Examination

01/07/2025The Securities and Exchange Commission (the Commission) hereby notifies all applicants for registration as Capital Market Operators that the next cycle of the pre-registration training and examination is scheduled to commence on Monday, July 7, 2025. Eligible applicants are as follows: Applicants who were invited but did not attend the pre-registration training conducted in March […]

Circular On The Expiration Of The Companies Income Tax (Exemption Of Bonds And Short-Term Government Securities) Order, 2011

01/07/2025The Securities and Exchange Commission (SEC) wishes to bring to the attention of all regulated entities and stakeholders that the ten-year period granted under the Companies Income Tax (Exemption of Bonds and Short-Term Government Securities) Order, 2011 lapsed in December 2021. As a result, interest income from the following instruments may now be subject to […]

Illegal Operator Alert – Value Growth Platform

30/06/2025The attention of the Securities and Exchange Commission (the Commission) has been drawn to the activities of an online platform known as VALUE GROWTH PLATFORM, which holds itself out as an Investment Platform that provides investors with market analysis reports, recommendations for investment and trading on their behalf. The Commission hereby informs the public that VALUE […]

Circular On Review And Processing Of Applications For Commercial Papers

25/06/2025The Securities and Exchange Commission (“the Commission”) hereby notifies all capital market stakeholders and prospective issuers that further to the “Rules on Issuance of Commercial Papers” issued on December 23, 2024, the submission and processing of applications for the issuance of commercial papers would commence on July 1, 2025. Accordingly, all applications for the issuance […]

Illegal Operator – CMTrading

20/06/2025The attention of the Securities and Exchange Commission (the Commission) has been drawn to the activities of an online platform known as CMTRADING, which holds itself out as a cryptocurrency and commodities trading platform. The platform claims to be licenced as GCMT SOUTH AFRICA PTY LTD by the Financial Sector Conduct Authority (FSCA) of South Africa […]

Circular To All Public Companies And Capital Market Operators On The Transmutation Of Independent Non-Executive Directors And Tenure Of Directors

19/06/2025Public Companies and Capital Market Operators: The attention of the Securities and Exchange Commission (the Commission) has been drawn to the prevalence in recent times of the rotation of various directorship positions among individuals within the same entity or Group of companies. In particular, the Commission observes the worrying trend of the transmutation/conversion of Independent […]

Illegal Operator Alert – Sapphire Scents Limited

19/06/2025The attention of the Securities and Exchange Commission (the Commission) has been drawn to the activities of Sapphire Scents Limited which holds itself out as an Investment Adviser/Fund Manager promoting an unregistered investment scheme. The Commission hereby informs the public that Sapphire Scents Limited is NOT REGISTERED to operate in any capacity in the Nigerian […]

Illegal Operator Alert – ZugaCoin and Samzuga GPT

17/06/2025The attention of the Securities and Exchange Commission (the Commission) has been drawn to online publications advertising unauthorized Crypto coins termed ZUGACOIN (with variants like SZCB and SZCB2) and SAMZUGA GPT. The Commission hereby informs the public that the promoters or issuers of ZUGACOIN and SAMZUGA GPT are NOT REGISTERED to operate in any capacity in the Nigerian […]

Illegal Operator Alert -CBEX (Crypto Bridge Exchange)-Super Technology-ST Technologies International Ltd

11/06/2025The attention of the Securities and Exchange Commission (The Commission) has been drawn to media reports indicating that CBEX (Crypto Bridge Exchange), operating under the corporate identity of ST Technologies International Ltd, also known as Smart Treasure/Super Technology, has resumed operations across Nigeria. According to the reports, CBEX promoters are demanding $200 from their subscribers with […]

Update on Enforcement Portal of the SEC website

07/06/2025The Securities and Exchange Commission (SEC) wishes to inform the public that the content hosted on the Enforcement Portal of the SEC website is currently being reviewed. In the interim, members of the public seeking information on the Portal, regarding enforcement actions against any Capital Market Operator (CMO), are advised to contact the Commission directly […]

Illegal Operator Alert – Punisher Coin

05/06/2025“PUNISHER COIN” The attention of the Securities and Exchange Commission (“The Commission”) has been drawn to several online publications advertising an unauthorized presale of Crypto coin termed “PUNISHER COIN” aka “$PUN”. The Commission hereby informs the public that the promoters or issuers of “PUNISHER COIN” aka “$PUN” are NOT REGISTERED to operate in any capacity in the Nigerian […]

Circular On The Implementation Of A New Settlement Cycle For Equities Transactions In The Nigerian Capital Market

03/06/2025Further to a comprehensive review of the current settlement cycle in the Nigerian capital market and extensive engagements with stakeholders, the Securities and Exchange Commission (“the Commission”) hereby informs all capital market stakeholders that the equities segment of the market would transition to a T+2 (i.e. trade date plus two days) settlement cycle, effective from […]

Illegal Operator Alert – Silverkuun Investment Cooperative Society/Silverkuun Limited

28/05/2025The attention of the Securities and Exchange Commission (“the Commission”) has been drawn to the activities of Silverkuun Investment Cooperative Society/Silverkuun Limited which holds itself out as an Investment Adviser/Fund Manager. The Commission hereby informs the public that Silverkuun Investment Cooperative Society/Silverkuun Limited is NOT REGISTERED to operate in any capacity in the Nigerian Capital […]

New SEC Nigeria Website

22/05/2025We are pleased to inform you that our official website is undergoing a redesign and upgrade as part of our ongoing commitment to improving service delivery and transparency in the Nigerian Capital Market. Kindly visit us at https://home.sec.gov.ng

Public Notice – Property World Africa Network (PWAN)/PWANMax

06/05/2025The attention of the Securities and Exchange Commission (“The Commission”) has been drawn to the activities of “Property World Africa Network” (PWAN), which holds itself out as a real estate investment company and is soliciting funds from the public for investment purposes, through “PWAN MAX”. The Commission hereby informs the public that PWAN/PWAN MAX are NOT […]

Postponement of First Capital Market Committee (CMC) Meeting of 2025

03/05/202530/04/2025 The 2025 first Capital Market Committee (CMC) Meeting earlier scheduled to hold on Friday, 9th May 2025 at Federal Palace Hotel, Victoria Island, Lagos has been postponed. The meeting will now hold on Monday, 19th May 2025 at the same venue. Attendance remains strictly by invitation. All invited participants are expected to be seated […]

Public Notice – Tofro.com

30/04/2025The attention of the Securities and Exchange Commission (“The Commission”) has been drawn to the activities of an online platform known as TOFRO.COM (Tofro), which holds itself out as a cryptocurrency trading platform. The Commission hereby informs the public that the Tofro is NOT REGISTERED by the Commission either to solicit investments from the public or operate […]

CBEX(Crypto Bridge Exchange) / Super Technology/ ST Technologies International Ltd

17/04/2025The attention of the Securities and Exchange Commission (“The Commission”) has been drawn to recent media reports/publications on the activities of CBEX (Crypto Bridge Exchange). CBEX, which also operates under the corporate identity of ST Technologies International Ltd, Smart Treasure/Super Technology, has held itself out as a digital asset trading platform, offering high returns to investors in […]

Notification of First Capital Market Committee (CMC) Meeting of 2025

17/04/202515/04/2025 The 2025 first Capital Market Committee (CMC) Meeting has been scheduled to hold on Friday, 9th May 2025 in Lagos. Attendance is strictly by invitation. All invited participants are expected to be seated by 8.45am. Thank you. SIGNED MANAGEMENT

Circular On First Registration Meeting For 2025

03/04/2025The Securities and Exchange Commission (“the Commission”) has scheduled its first registration meeting for 2025 to consider applications: i. from aspiring capital market operators; ii. in respect of the registration of additional sponsored individuals; iii. for the transfer of existing sponsored individuals to new firms; iv. for change in the status or function of sponsored […]

Notice Of Cancellation Of Registration Of Mainland Trust Limited

14/03/2025PUBLIC NOTICE Notice Of Cancellation Of Registration Of Mainland Trust Limited The Securities and Exchange Commission (“the Commission”) hereby notifies the general public that the registration of Mainland Trust Limited as a capital market operator has been cancelled with immediate effect. This cancelation order is made pursuant to the powers of the Commission under Section […]

Notice Of Suspension Of Centurion Registrars Limited, Its Directors And Sponsored Individuals From Capital Market Activities

14/03/2025PUBLIC NOTICE Notice Of Suspension Of Centurion Registrars Limited, Its Directors And Sponsored Individuals From Capital Market Activities The Securities and Exchange Commission (“the Commission”) hereby notifies the general public of the suspension of Centurion Registrars Limited, its sponsored individuals and Directors from all capital market activities with immediate effect. This suspension order is made […]

Update On Financial Action Task Force List Of Identified Jurisdictions In February 2025

13/03/2025UPDATE ON FINANCIAL ACTION TASK FORCE LIST OF IDENTIFIED JURISDICTIONS IN FEBRUARY 2025 All Capital Market Operators, Experts and Stakeholders are hereby notified that the Financial Action Task Force (FATF), at its plenary meeting of 21st February, 2025 updated its lists of High-Risk Jurisdictions Subject to a Call for Action (Black List) and Jurisdictions Under […]

Additional Enforcement Measures On Erring Capital Market Operators

12/03/2025PUBLIC NOTICE Additional Enforcement Measures On Erring Capital Market Operators In furtherance of the Commission’s unwavering commitment to the maintenance of a zero tolerance for infractions in the Nigerian Capital Market and in line with its revised enforcement strategies, stakeholders and the general public are hereby informed that henceforth, the names of Capital Market Operators […]

Illegal Operator Alert – Provest

06/03/2025ILLEGAL OPERATOR ALERT! PRO-VEST The attention of the Securities and Exchange Commission (SEC) has been drawn to the activities of Promiseland Estates Limited and Promiseland Building & Construction Limited which hold themselves out as Investment Advisers/Fund Managers in the Nigerian Capital Market and promote an illegal investment scheme called “PRO-VEST”. The Commission hereby notifies the […]

Unregistered Operator – Stecs (Alausa) Multipurpose Cooperative Society

24/01/2025SECURITIES AND EXCHANGE COMMISSION PLOT 272 SAMUEL ADESUJO ADEMULEGUN STREET CENTRAL BUSINESS DISTRICT P.M.B 315, GARKI-ABUJA, FCT TEL: +2342094621168-9 Email: sec@sec.gov.ng PUBLIC NOTICE The attention of the Securities and Exchange Commission (“the Commission”) has been drawn to the activities of Stecs (Alausa) Multipurpose Cooperative Society (popularly known as Stecs), which is engaging in capital market […]

Unregistered operator – Risevest (Victoria Island) Cooperative Multipurpose Society Limited

24/01/2025SECURITIES AND EXCHANGE COMMISSION PLOT 272 SAMUEL ADESUJO ADEMULEGUN STREET CENTRAL BUSINESS DISTRICT P.M.B 315, GARKI-ABUJA, FCT TEL: +2342094621168-9 Email: sec@sec.gov.ng PUBLIC NOTICE The attention of the Securities and Exchange Commission (“the Commission”) has been drawn to the activities of Risevest (Victoria Island) Cooperative Multipurpose Society Limited, which is engaging in capital market activities […]

Relocation Of Monitoring And Enforcement Departments

22/01/2025SECURITIES AND EXCHANGE COMMISSION PLOT 272, SAMUEL ADESUJO ADEMULEGUN STREET, CENTRAL BUSINESS DISTRICT, P.M.B 315, GARKI-ABUJA, FCT TEL: +2342094621168-9 Email: sec@sec.gov.ng PUBLIC NOTICE! RELOCATION OF MONITORING AND ENFORCEMENT DEPARTMENTS The Commission wishes to inform the capital market community and the general public of the relocation of its Monitoring and Enforcement Departments from the Nigerian Capital […]

New Year Message 2025

01/01/2025Circular To All Public Companies – Publication of Periodic Returns on Company Websites

17/12/2024CIRCULAR TO ALL PUBLIC COMPANIES The Securities and Exchange Commission (“the Commission”) has observed that public companies file their periodic returns with the Commission and relevant securities exchanges, without simultaneously publishing same on their websites. This omission is a contravention of Rules 39 and 41 of the Commission’s Rules and Regulations. Public companies are hereby […]

Webinar- Unlocking the potentials of non-interest finance in Nigeria’s mortgage sector

14/11/2024Click here to register

Press Release: Update on the SEC’s Accelerated Regulatory Incubation Program and Regulatory Incubation Program

29/08/2024In furtherance of its commitment to enabling innovation that would deepen the capital market while guaranteeing the protection of investors, the Securities and Exchange Commission (“the SEC”) hereby announces that two (2) Digital Assets Exchanges have been granted “Approval-in-Principle” to commence operation under the Accelerated Regulatory Incubation Program [“ARIP”]. Similarly, 5 firms have been admitted […]

Inauguration Of Board Of The Securities And Exchange Commission

25/07/2024The Securities and Exchange Commission (“the Commission”) on Monday July 8, 2024 marked another significant milestone with the inauguration of its Board at the Federal Ministry of Finance, Abuja. The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun who conducted the inauguration, congratulated the Board Members on their appointment by His […]

2nd Pre-Registration Examination For Sponsored Individuals

17/07/2024This is to notify all persons who applied for the role of sponsored individuals that the 2nd Pre-Registration Examination of 2024 is scheduled for August 1, 2024. All eligible applicants who have attended Pre-Registration Training but have not taken the examination are hereby required to register for the examination by filling the attached template and […]

Scammer Alert

05/07/2024The Securities and Exchange Commission (“the Commission”) has become aware of several fraud attempts targeting the investing public and our online community. These scammers are impersonating the Director General of the Commission – Dr. Emomotimi Agama with the aim of luring unsuspecting members of the public into sharing personal information and making unauthorized payments. Please […]

Revamped E-Dividend Mandate Management System Portal

02/07/2024The Securities and Exchange Commission (“the Commission”) hereby announces the launch of the revamped e-Dividend Mandate Management System (e-DMMS) Portal. This initiative is another important step towards curbing the growth of unclaimed dividend and generally improving investor experience in the Nigerian Capital market. The revamped e-DMMS Portal introduces a “self-service interface” that allows investors apply […]

Framework On Accelerated Regulatory Incubation Program (ARIP) For The Onboarding Of Virtual Assets Service Providers (VASPs)

21/06/2024The Securities and Exchange Commission [“the Commission”] hereby notifies the general public, that the Rules on Digital Assets Issuance, Offering Platforms, Exchange and Custody is going through an amendment process. The purpose of the amendment is to expand the scope of regulation in line with the current realities. The Commission hereby provides a special window […]

Ponzi: Famzhi Boss Jailed Five Years for Investment Scam

19/06/2024In a major boost to the enforcement activities of the Securities and Exchange Commission, the Managing Director of Famzhi Interbiz Ltd, Mariam Suleiman has been sentenced to five years’ imprisonment without the option of a fine for defrauding investors of over N2 billion. Justice Inyang Ekwo of Federal High Court, Abuja, found Suleiman and Famzhi Interbiz Ltd guilty on counts one and two of the […]

Implementation of Enterprise Risk Management

14/06/2024All Capital Market Operators (CMOs) are hereby directed to implement an Enterprise Risk Management (ERM) framework that conforms to international standards such as the Committee of Sponsoring Organizations of the Treadway Commission (COSO), the International Organization for Standardization (ISO 31000), Financial Action Task Force (FATF) Recommendations and any other internationally recognized risk management standards. Adoption […]

Notification for the 2024 Capital Market Committee 1ST Webinar Meeting

25/03/202422/03/2024 The Director General has approved the 2024 Capital Market Committee (CMC) 1ST Webinar Meeting to hold on Thursday, 18TH April 2024. The usual interface with members of the press will hold the following day Friday, 19th April 2024 through Webinar. Attendance to both events is strictly by invitation. All invited participants are expected to be seated by 9:45 am. Thank you, SIGNED MANAGEMENT

Mandatory Audit Firm Rotation In Public Companies (Joint Audit)

01/03/2024The Nigerian Code of Corporate Governance (NCCG) 2018, issued by the Financial Reporting Council of Nigeria (FRC), provides for a 10-year period for the rotation of auditors to public companies. The code however did not provide a rotation period for audit firms in the case of Joint Auditors. Consequent to the above, the Financial Reporting […]

Re: Compliance Of Public Companies With Sections 60-63 Of The Investments And Securities Act (2007)

19/02/2024Further to the Commission’s circular dated 8th November, 2021 on the compliance by Public Companies with the requirements of Sections 60 to 63 of the Investments and Securities Act 2007 on Internal Control over Financial Reporting, the Commission hereby notifies the reporting entities that the Directors and External Auditors’ reports on Internal Control over Financial Reporting (ICFR) for the […]

The SEC Regulatory Incubation Program: Call for Applications into Cohort 002/24

16/02/2024The Securities and Exchange Commission (SEC) hereby announces the launch of the second Cohort (Cohort 002/24) of its Regulatory Incubation (RI) program. The portal for submitting applications is now open to receive applications from 05/02/2024 to 08/04/2024. For comprehensive guidance on how to apply for admission into the Regulatory Incubation Program, please visit the SEC Innovation […]

Notice To All Capital Market Operators (CMOS) On 2024 Renewal Of Registration

22/12/2023This is to inform all Capital Market Operators (CMOs) and the general public that the annual renewal of Registration of CMOs for the year 2024 will commence from 1st January, 2024 to January 31, 2024. In line with the Commission’s Rules & Regulations, all CMOs are to complete the process of renewal of registration for […]

Public Notice On Sealing Up Of Ready Finance Investors Ltd

18/12/2023The Securities and Exchange Commission (the Commission) on Tuesday December 12, 2023 sealed up Ready Finance Investors Limited for engaging in illegal capital market activities. The activities of unregistered operators violate the established laws and regulations governing the Nigeria capital market and pose a significant threat to the financial markets. Members of the public are […]

Re-Advertisement – Design, Supply and Installation of Securities Market Surveillance System

21/11/2023Specific Procurement Notice Design, Supply and Installation of Securities Market Surveillance System and Related Goods and Services Purchaser: SECURITIES & EXCHANGE COMMISSION, NIGERIA Project: Deployment of Real-time Surveillance System for the Nigeria Securities Market and ancillary services at the Securities and Exchange Commission Contract title: PROCUREMENT OF SECURITIES MARKET SURVEILLANCE SYSTEM Country: NIGERIA Grant No.: […]

Notification for the Third CMC Meeting in 2023

19/10/2023The Third Capital Market Committee (CMC) Meeting for 2023 is scheduled to take place on Thursday, November 16, 2023, at the Federal Palace Hotel, Victoria Island, Lagos. An interaction session with members of the press will hold the following day, Friday, November 17, 2023, at the SEC Lagos Zonal Office, located at Number 3 Idejo […]

Extension of Investments and Securities (Exemption of State Governments etc.) Order 2019

22/09/2023The Securities and Exchange Commission wishes to notify all Capital Market Operators (CMOs) and the general public that the Federal Ministry of Finance has approved a further extension of validity period of the Investment and Securities (Exemption of State Governments etc. – ’’Exemption Order’’) Order 2019 by three years from December 27, 2022 to December […]

Revised Schedule for the 2023 Capital Market Committee 2nd Webinar Meeting

10/08/202310th August, 2023 We wish to inform you of an adjustment to the originally planned schedule for the Capital Market Committee meeting. The meeting, which was initially scheduled for Wednesday, August 23rd, has been rescheduled to take place on Thursday, August 24th, 2023. Additionally, we would like to remind you that our regular interaction with […]

Warning Against Investing With Binance

28/07/2023In futherance of the Commission’s earlier circular, dated 9 June, 2023, with respect to the website operated by Binance (https://www.binance.com) used for soliciting the Nigerian public to trade crypto assets. The Commission again reiterates that the activities of Binance, https://www.binance.com and any such other platform through which the Company solicits investors is neither registered nor […]

SEC Financial Statements Duly Audited Over The Years

23/06/2023The attention of the Securities and Exchange Commission (the Commission), the apex regulator of the Nigerian capital market has been drawn to some reports in the electronic and print media, insinuating that the Commission had not audited its financial statements since 2014. Contrary to these false claims, the Commission as a law-abiding agency has duly […]

Circular on the Activities of Binance Nigeria Limited

09/06/2023The attention of the Securities and Exchange Commission (the Commission) has been drawn to the website operated by Binance Nigeria Limited, soliciting the Nigerian public to trade crypto assets on its various web and mobile-enabled platforms. Binance Nigeria Limited is neither registered nor regulated by the Commission and its operations in Nigeria are therefore illegal. […]

Notification For The 2023 Capital Market Committee 2nd Webinar Meeting

07/06/2023The Director General has approved the 2023 Capital Market Committee (CMC) 2nd Webinar Meeting to hold on Wednesday, 23rd, August 2023. The usual interface with members of the press will hold the following day Thursday, 24th August 2023 through Webinar. Attendance to both events is strictly by invitation. All invited participants are expected to be […]

Official Disclaimer On Fake SEC Websites

12/05/2023The attention of the Securities and Exchange Commission (“the Commission”) has been drawn to several websites and blogs purportedly affiliated to the Commission. The referenced websites are fake and not in any way related to the Commission. For the avoidance of doubt, the Commission’s website is www.sec.gov.ng. The general public is therefore strongly advised to […]

Notice of Acceptance of Applications for the Regulatory Incubation (RI) Program

28/04/2023Please refer to the Securities and Exchange Commission (SEC) circular of June 2021 announcing its Regulatory Incubation (RI) program for FinTech firms operating or seeking to operate in the Nigerian Capital Market. This is to inform you that the portal for submitting applications is now ready to receive applications from Cohort 001/23, from 28/04/2023 to […]

Blacklisting Of Six (6) Unregulated Online Trading Platforms

27/04/202319/04/2023 The Commission’s attention has been drawn to the under listed e-commerce Companies and their websites offering online trading platforms to the investing public. They are not registered by the SEC Nigeria and the financial services offered by them are also not authorized. Prime Invest and “Primeinv.co (Websites: http://primeinv.co and https://webtrader.pinvest.cc); FXBoxed (Websites: www.fxboxed.com and […]

The Supreme Court affirms the jurisdiction of the Investments and Securities Tribunal over capital market disputes

05/04/2023The Supreme Court affirms the jurisdiction of the Investments and Securities Tribunal over capital market disputes: (A review of SC/314/2007 – Mufutau Ajaji vs SEC). On January 13, 2023, the Supreme Court of Nigeria delivered a landmark decision with enormous implication for capital market dispute resolution. This was in the case of Mufutau Ajayi vs […]

Investors Alert – Blacklisting Of Five (5) Italian E-Commerce Websites

30/03/202322/03/2023 The Italian Securities Regulator, (Commissione Nazionale per le Soecieta’ e la Borsa – CONSOB) has blacklisted five (5) additional e-commerce websites for offering unauthorized and fraudulent financial services. The blacklisted websites are: CMS Ltd (capmarketstrategy.io, with its page https://client.capmarketstrategy.io); Bitsterzio(https://www.bitsterzio.com); Invest Atlas (https://investatlas.co) Ether-Arena Ltd (www.ether-arena.com); and Ether-Arena Ltd (https://veneab.co, with its page: https://clientzone,vineab.com ). […]

Public Statement On Recent Reports On Seplat Energy PLC

29/03/2023The Commission’s attention has been drawn to the recent reports in the media regarding Seplat Energy Plc (Seplat), a public company listed on the Nigerian Exchange Limited (NGX) and the London Stock Exchange (LSE). In line with its core mandate of investor protection, the Commission has sought and obtained explanations from Seplat through its Board of Directors and […]

Notification for 2023 First CMC Webinar Meeting

22/03/2023The 2023 first Capital Market Committee (CMC) Webinar Meeting has been scheduled to hold on Wednesday, 12th April, 2023. The usual interface with members of the press will also hold through webinar on Thursday, 13th April, 2023. Attendance at both events is strictly by invitation. All invited participants are expected to be seated by 9.45am. Thank you. SIGNED MANAGEMENT

Ponzi: Court Sets March 16 for Trial of Vektr Capital & 2 Ot

13/02/2023Justice Zainab Abubakar of the Federal High Court, Court 4, Abuja has set March 16, 2023 for the commencement of trial of Vektr Capital Global Group along with two staff of the company, Mr. Solomon Edet Solomon and Mr. Zakari Haruna for allegedly operating as fund managers without registration by the Securities and Exchange Commission […]

Corrigendum – Prequalification and Expression of Interest (EOI). PROJECT ID NO: P-NG-HZ0-007

18/01/2023The attention of the general public is hereby drawn to the earlier advertisement published by the Securities and Exchange Commission in the Federal Tenders Journal, Daily Trust and Thisday Newspapers on Monday December 26, 2022 and Tuesday December 27, 2022 respectively, inviting members of the public for prequalification and Expression of Interest (EOI). PROJECT ID […]

Nigerian Capital Market Institute – 2023 Training Calendar

04/01/2023Registration form (Fill after Viewing courses below) ——————————————– Contact information Email: ncmi@sec.gov.ng or eagama@sec.gov.ng or gayoo@sec.gov.ng Address: No. 14 Yawuri St, behind Rita Lori Hotel, Garki , Federal Capital Territory Phone: +234 803 450 3686, +234 803 289 1344 , +234 805 434 3959 ———————————————

Blacklisting Of Four (4) Italian E-Commerce Companies

22/12/2022The attention of the Securities and Exchange Commission, Nigeria (“SEC”) has been drawn to a report that the Italian securities regulator, (Commissione Nazionale per le Soecieta’ e la Borsa – CONSOB) has blacklisted four (4) e-commerce companies and blocked their websites for fraudulent e-trading and unauthorized offering of financial services. The blacklisted companies and their […]

Request For Expressions Of Interest (Consulting Services-Firms)

22/12/2022Institutional Capacity Development on Green Finance and Green Bonds for the Securities and Exchange Commission, Nigerian Exchange Group and Capital Market Operators SECTOR: NIGERIAN CAPITAL MARKET GRANT NO.: G-NG-H00-SUP-001: PROJECT ID NO.: P-NG-HZ0-007 The SECURITIES & EXCHANGE COMMISSION, NIGERIA (SEC) has received financing from the African Development Bank towards the cost of regulatory capacity improvements […]

Notice To All Capital Market Operators (CMOs) For Renewal Of 2023 Registration.

12/12/2022This is to inform all Capital Market Operators and the general public that the annual renewal of Registration for year 2023 will commence from January 01, 2023 to January 31, 2023. In line with the Commission’s Rules and Regulations, all CMOs are to complete the process of renewal of registration for 2023 on or before […]

Circular On Designation Of Ten Individuals And Three Entities By The National Sanctions Committee And Addition To The Nigeria Sanctions List

10/11/2022NSC/SEC/MON/AML/CFT/112022/02 All Capital Market Operators (CMOs) and Stakeholders are hereby notified that pursuant to section 49 of the Terrorism (Prevention and Prohibition) Act, 2022, the Nigeria Sanctions Committee has approved the addition of the entries below to the Nigeria Sanctions List of individuals and entities subject to assets freeze, travel ban and arms embargo: Abdurrahaman […]

Notification for Third CMC meeting in 2022 and the launch of the Nigerian Capital Market Masterplan (2021 -2025).

01/11/2022The 2022 Third Capital Market Committee (CMC) Meeting has been scheduled to hold on Thursday, 24TH November, 2022 at the Lagos Continental Hotel, Plot 52, Kofo Abayomi Street, Victoria Island, Lagos, Nigeria. The usual interface with members of the press will hold the following day being Friday, 25TH November, 2022 at the SEC Lagos Zonal […]

Amendment to the Investment and Securities (Exemption of State Government etc.) Order, 2019

27/09/2022The Securities and Exchange Commission wishes to notify all Capital Market Operators (CMOs) and the general public that the Honourable Minister of Finance, Budget and National Development has approved an amendment to the Investment and Securities (Exemption of State Governments etc.) Order 2019. The Order, which was initially published in the Official Gazette of the […]

Circular On Periodic Updates Of Registered Farmers Cooperatives And Warehouses Linked To Commodity Exchanges

01/09/2022The Commission hereby directs that all Commodity Exchanges registered with the Commission are henceforth required to include information on the number of registered farmer cooperatives and warehouses linked to their respective Exchanges in their quarterly reports which falls due for submission not later than 30 days from the end of each quarter. This directive is […]

Rules on Issuance Offering and Custody of Digital Assets_SEC NIGERIA 11 MAY 2022

13/05/2022Rules on Issuance Offering and Custody of Digital Assets_SEC NIGERIA 11 MAY 2022

Circular On Processing Fee For Fairness Review Of Mergers, Takeovers And Acquisitions By The Securities And Exchange Commission, Nigeria

11/04/2022The Commission, pursuant to its powers under the Investment and Securities Act (ISA), 2007, and Rule 6 of the Amended Rules on Mergers, Takeovers and Acquisitions, by this circular, hereby notify all public companies involved in or intending to be involved in a merger, acquisition, or other forms of corporate restructuring that the applicable ’’processing […]

Activities Of Some Unregistered Investments Schemes

17/03/2022The Securities and Exchange Commission (“SEC”), on March 14, 2022 shut the offices of the following companies: OXFORD INTERNATIONAL GROUP/OXFORD COMMERCIAL SERVICES FARMFORTE AGRO ALLIED SOLUTIONS LIMITED/AGROPARTNERSHIPS VEKTR CAPITAL INVESTMENT/VEKTR ENTERPRISE The Commission hereby notifies the investing public that none of these entities is registered by the SEC and the Investment Schemes promoted by […]

Circular To Issuing Houses On “No-Objection For Transactions”

03/03/2022The Securities and Exchange Commission (“the Commission”) hereby draws the attention of Issuing Houses to the due diligence requirement for a “No-Objection” letter from “primary regulators” of Issuers, especially those in the Banking and Insurance sectors, as a prerequisite for the Commission’s approval of proposed transactions. In a bid to further improve the Commission’s transaction […]

Filing Of Annual Financial Statement (AFS) By Capital Market Operators

16/02/2022The Securities and Exchange Commission (SEC) wishes to notify all Capital Market Operators (CMOs) that the SEC has created a dedicated email account for the submission of Annual Financial Statements. Consequently, all audited financial statements should be submitted electronically to afs@sec.gov.ng. The financial statement must be in a selectable and searchable PDF format, which must […]

Re: Notice To All Capital Market Operators (CMOs) On 2022 Renewal Of Registration

21/01/2022Further to our earlier circular released on 16th December 2021 on the above subject, this is a reminder to all Capital Market Operators and relevant stakeholders that the 2022 Registration Renewal Exercise will end on 31st January 2022, and there will be no extension. The renewal portal can be accessed via eportal.sec.gov.ng Capital Market Operators […]

Submission Of Fourth (4th) Quarter Unaudited And Annual Audited Financial Statements By Public Companies

20/01/2022Sequel to the Pilot Scheme on filing of Fourth (4th) Quarter and Annual Audited Financial Statements by Public Companies introduced in March 2019, the Securities and Exchange Commission (SEC) hereby notifies all public companies of the available options on filing of 4th Quarter and Annual Audited Financial Statements: i. To file the Unaudited Fourth (4th) […]

FG’s Official Gazzette On Proscription Of Banditry And Screening Of Clients Against Sanction Lists

17/01/2022All Capital Market Operators (CMOs) are hereby notified that in line with the requirements of the Terrorism Prevention Act (No. 10,2011) and Terrorism (Prevention) Proscription Order Motion, 2021, the Federal Government of Nigeria has declared the activities of “YAN BINDIGA GROUP”, YAN TA’ADDA GROUP AND OTHER SIMILAR Groups in any part of Nigeria as Terrorism […]

Circular To All Registered Fund/Portfolio Managers On Annual Regulatory And Supervision Fees

27/12/2021The Commission hereby draws the attention of all registered Fund/Portfolio Managers to the SEC Rule on Annual Supervision Fees for Collective Investment Schemes (CIS) and Regulatory Fees for Discretionary and Non-Discretionary Funds/Portfolios issued on January, 21 2021 and the amendment thereto issued on December 20, 2021, which provides that: A Annual Supervisory fee for Collective Investments Schemes […]

Activities Of FinAfrica Investment Limited (Chinmark Group)

25/12/2021The attention of the Securities and Exchange Commission, Nigeria (“SEC”) has been drawn to the activities of an Illegal Operator (FINAFRICA INVESTMENT LIMITED). The Company claimed to be an Investment Company that engages in Business Development in Commercial sectors of the economy and uses the funds in entities under Chimark Group. The Commission hereby notifies […]

Activities Of Poyoyo Investment (Pilvest) Nigeria Limited

24/12/2021The attention of the Securities and Exchange Commission, Nigeria (“SEC”) has been drawn to the electronic and WhatsApp messages being circulated to investors on behalf of Poyoyo Investment (PILVEST) Nigeria Limited. The electronic message indicates a proposal to investors to invest in guaranteed investments with the following types of investment plans: Option A which is […]

Notice To All Capital Market Operators (CMOS) On 2022 Renewal Of Registration

16/12/2021This is to inform all Capital Market Operators (CMOs) and the general public that the annual renewal of Registration of CMOs for the year 2022 will commence from 1st January, 2022. In line with the Commission’s Rules & Regulations, all CMOs are to complete the process of renewal of registration for 2022 on or before […]

Circular On The Commencement Of Regulatory Fee On Fixed Income (Bonds) Secondary Market Transactions

16/12/2021This circular is made pursuant to Section 13(u) of the Investments and Securities Act (ISA), 2007 and Schedule 1, Part D of the SEC Rules (Registration Fees, Minimum Capital Requirements, Securities and others) which empower the Securities and Exchange Commission (SEC) to levy, among others, fees on transactions relating to investments and securities business in […]

Request For Expressions Of Interest (Consulting Services-Firms)

02/12/2021REQUEST FOR EXPRESSIONS OF INTEREST (CONSULTING SERVICES-FIRMS) NIGERIA RISK-BASED SUPERVISION FRAMEWORK IMPLEMENTATION AND CAPACITY BUILDING PROJECT Institutional Capacity Building on Regulation of Derivatives and Improvement of Derivatives Regulatory Framework SECTOR: NIGERIAN CAPITAL MARKET GRANT NO.: G-NG-H00-SUP-001: PROJECT ID NO.: P-NG-HZ0-007 The SECURITIES & EXCHANGE COMMISSION, NIGERIA (SEC) has received financing from the African Development Bank […]

Guidance On The Implementation Of Sections 60 – 63 Of The Investments And Securities Act, 2007 – Extension Of Compliance Date To December 2023

08/11/2021Further to our circular on the framework for the implementation of Sections 60 to 63 of the Investments and Securities Act, 2007, published on Monday, March 08, 2021 in the Guardian and Business Day newspapers, wherein directors are required to implement relevant internal controls over financial reporting and Auditors are required to review same and […]

Notification For 2021 Third CMC Webinar Meeting

20/10/2021The 2021 Third Capital Market Committee (CMC) Webinar Meeting has been scheduled to hold on Thursday, 11th November, 2021. The usual interface with members of the press will hold the following day being Friday, 12th November, 2021. Attendance at both events is strictly by invitation. All invited participants are expected to be seated by 9.45am. […]

Request for Expression of interest (Consulting Services-Firms)

16/08/2021NIGERIA RISK-BASED SUPERVISION FRAMEWORK IMPLEMENTATION PROJECT SECTOR: NIGERIAN CAPITAL MARKET GRANT NO.: G-NG-H00-SUP-001: PROJECT ID NO.: P-NG-HZ0-007 The SECURITIES & EXCHANGE COMMISSION, NIGERIA (SEC) has received financing from the African Development Bank towards the cost of regulatory capacity improvements under the RISK-BASED SUPERVISION FRAMEWORK AND CAPCITY BUILDING PROJECT, and intends to apply part of the […]

Update On Renewal Of Registration By Capital Market Operators

13/08/2021The Securities and Exchange Commission (“the Commission”) refers to its previous Circulars and e-mail dated 28th June 2021 on the renewal of registration of Capital Market Operators. Capital Market Operators are hereby informed that the Commission has re-opened its renewal portal (www.eportal.sec.gov.ng) to enable Operators that have not renewed their registration for 2021 to do […]

General Procurement Notice – Risk Based Supervision Framework Implementation And Capacity Development Project

10/08/2021The Securities & Exchange Commission, Nigeria has received a grant from the African Development Bank Group administered/Capital Markets Development Trust Fund to finance the Risk Based Supervision Framework Implementation and Capacity Development Project. The principal objectives of this project are to: Provide technical assistance and capacity building on selected areas of the Commission’s operations, […]

Judgement Of The Federal High Court In Respect Of BARA Finance & Investment Ltd And Its Management/Promoters

05/08/2021The Securities and Exchange Commission (“the Commission”) wishes to draw the attention of the general public to the judgement of the Federal High Court siting in Abuja on the 28th day of June 2021, in respect of BARA FINANCE & INVESTMENT LTD, wherein the company as well as MESSRS EDE AGIDA PETERS and OLOM OJEBONG […]

Proposed major amendment to rules on securities exchanges and other sundry amendments

27/07/2021Major Amendment Proposed Amendment to Part E- Rules on Securities Exchanges. View all amendments here All comments and input should be forwarded by e-mail to the Secretariat, Rules Committee of the Commission, at rulescommittee@sec.gov.ng or by letter addressed to the Director-General, SEC, not later than two (2) weeks from date of publication.

OANDO Plc Enters Into A Settlement With The Securities And Exchange Commission

19/07/2021Pursuant to the powers conferred on the Securities and Exchange Commission (the Commission) by the Investments and Securities Act 2007, and the Rules and Regulations made pursuant thereto, the Commission on Thursday, July 15, 2021, entered into a Settlement with Oando Plc (the Company). The Commission in its letter to the Company dated May 31, […]

Official Disclaimer on SEC Registration of MBA Capital and Trading Limited

22/06/2021The attention of the Securities and Exchange Commission (“the Commission”) has been drawn to a publication in one of the National Daily Newspapers, in which a victim of an alleged scam perpetrated by MBA Capital and Trading Limited, Misan Sagay reportedly stated that he had verified “on-line” and ascertained that the company was registered with […]

SEC Nigeria Takes Over Leadership Of The West Africa Securities Regulators Association (WASRA)

16/06/2021Mr. Lamido Yuguda, the Director General of the Securities and Exchange Commission, Nigeria took over the mantle of leadership of the West African Securities Regulators Association (WASRA) as Chairman, on Monday, 14th June, 2021. Mr. Yuguda will lead the body of West African securities regulators for a two-year period having succeeded Reverend Daniel Ogbarmey Tetteh, […]

Deadline for registration as a crowdfunding intermediary/platform

11/06/2021This is to inform all existing investment crowdfunding portals/digital commodities investment platforms operating in Nigeria that the deadline for registration is 30th June 2021. Failure to comply with this deadline will mean that the operations of such platforms will be categorized as illegal and attract regulatory sanction as stipulated in the Rules (which came into […]

Notice To The Public On Crowdyvest Halal Fund

31/05/2021The attention of the Commission was drawn to the proposed launch of a Crowdyvest Halal Fund by Crowdyvest an unregistered entity purporting to operate as a corporative society. The Commission has since issued a Cease and Desist Order to Crowdyvest to stop the launch and operations of the Crowdyvest Halal Fund and any other investment […]

Effective Date Of The Crowdfunding Rules

26/05/2021This is to inform all stakeholders that as part of efforts to ensure investor protection while encouraging innovation in the conduct of securities business, the rules governing Crowdfunding business in Nigeria came into effect on the 21st day of January, 2021. In line with the transitional provisions of the Rules, all persons/entities operating an investment […]

Update on Renewal of Registration for Capital Market Operators

10/05/2021The Securities and Exchange Commission (SEC) wishes to inform all registered Capital Market Operators (CMOs) that in line with the requirements for renewal of registration, all CMOs are required to complete the renewal process on or before April 30, 2021. Consequently, all CMOs are expected to note the following; 1. Late filing for renewal of […]

Official Disclaimer on Fake SEC Website and Fictitious Recruitment Exercise

30/04/2021The attention of the Securities and Exchange Commission (“the Commission”) has been drawn to several websites and blogs purportedly affiliated to the Commission which are said to be advertising on-going “recruitment exercise” by the Commission. The Commission wishes to inform the general public that the referenced websites and blogs are fake and that no such […]

Press Release – Update On Suspension Of The Annual General Meeting Of OANDO PLC

30/04/2021The attention of the Securities and Exchange Commission (“The Commission”) has been drawn to publications in various media on the judgments against the Commission concerning its regulatory action on Oando Plc and several of its officers for severe breaches of capital market regulations, some of which are under criminal investigations. It is therefore important that […]

Call For Proposal – ICT Transformation – Development of ICT Transformation Strategy

27/04/2021Download TOR – SEC Nigeria Digital Transformation

Proliferation of Unregistered Online Investment and Trading Platforms Facilitating Access to Trading in Securities Listed in Foreign Markets

08/04/2021The attention of the Securities and Exchange Commission (the Commission) has been drawn to the existence of several providers of online investment and trading platforms which purportedly facilitate direct access of the investing public in the Federal Republic of Nigeria to securities of foreign Companies listed on Securities Exchanges registered in other jurisdictions. These platforms […]

Circular On Warehousing And Collateral Management

29/03/2021The Securities and Exchange Commission wishes to bring to the notice of the general public and Capital Market Operators (CMOs) of its rules and regulation on Warehousing and Collateral Management Rules. These Rules were developed to provide a regulatory framework for the operations of Warehouses that store commodities to be traded on Commodities Exchanges, Collateral […]

Motion for Injuction / Stay of Execution – Engineer Patrick Ajudua Vs SEC & OANDO Plc

26/03/2021The Securities and Exchange Commission (SEC) wishes to inform the general public that it has filed a Motion for Injunction/Stay of Execution of the judgment and Order of the FCT High Court in Suit No: FCT/HC/BW/CV/347/2020, ENGINEER PATRICK AJUDUA Vs SECURITIES and EXCHANGE COMMISSION & OANDO PLC. Consequently, to avoid being in contempt of court, […]

Circular On The Renewal Of Registration

23/03/2021The Securities and Exchange Commission (SEC) hereby notifies the general public and Capital Market Operators (CMOs) in particular, of the reintroduction of the periodic renewal of registration by Capital Market Operators. The reintroduction of renewal of registration is premised on the need: to have a reliable data bank of all CMOs registered and active […]

Guidance On The Implementation Of Sections 60 – 63_Of The Investments And Securities Act_2007

08/03/2021The global corporate scandals that occurred in 2001 were linked to weaknesses in financial reporting and accounting practices. In response, several jurisdictions enacted legislations to enhance transparency and uphold the intergrity of financial markets. As part of the efforts to reform corporate financial reporting in Nigeria, the Federal Government of Nigeria passed the amended Investments […]

Securities and Exchange Commission’s 5th Budget Seminar

05/03/2021The Commission will hold its 5th Budget Seminar Series with the theme, “Financing Nigeria’s Budget and Infrastructure Deficits through the Capital Market” on Thursday, 11th March, 2021 in a Webinar at 10:00 am. The focus of this year’s edition of the Seminar is to discuss how the capital market can aid the flow of private capital to address Nigeria’s […]

Press Statement

24/02/2021The attention of the Securities and Exchange Commission (the Commission) has been drawn to several publications in the media, where it is reported that a shareholder of OandoPlc, purportedly obtained a judgment from the Federal Capital Territory High Court against the Commission. The Commission wishes to inform the general public that it was never at […]

Notification For 2021 First CMC Webinar Meeting

17/02/2021The 2021 First Capital Market Committee (CMC) Webinar Meeting has been scheduled to hold on Thursday, 15th April, 2021. The usual interface with members of the press will also hold through webinar the following day being Friday, 16th April, 2021. Attendance at both events is strictly by invitation. All invited participants are expected to be […]

Press Release On Cryptocurrencies

11/02/2021The Securities and Exchange Commission (SEC) has received several comments and inquiries from the public on a perceived policy conflict between the SEC Statement on Digital Assets and their Classification and Treatment of September 11, 2020 and the Central Bank of Nigeria (CBN) Circular of February 5, 2021. We see no such contradictions or inconsistencies. […]

The Investments And Securities Tribunal (IST) Restrains Unregistered Fintech Company From Stock Trading

19/12/2020The Investments and Securities Tribunal, (IST) on Thursday 17th December 2020, made interim Orders restraining a Fintech company, Chaka Technologies Limited, and its promoters from advertising or offering for sale shares, stock or other securities of companies or other entities. The interim Orders, which apply to all Chaka platforms, were granted pursuant to an application […]

Circular To Regulated Entities And Capital Market Stakeholders

18/12/2020The Federal Ministry of Health and the Nigeria Centre for Disease Control (NCDC) has warned that the country is on the verge of a second wave of the COVID-19 pandemic. In light of the rising number of new cases, the Commission wishes to provide the following guidance: All stakeholders in the Nigerian capital market are […]

Conduct Of Illegal Fund Management By Famzhi Interbiz Limited

18/12/2020The attention of the Securities and Exchange Commission (the Commission) has been drawn to the illegal fund management operation conducted by FAMZHI INTERBIZ LIMITED. The Commission wishes to inform the public that FAMZHI INTERBIZ LIMITED is not registered to operate in the Nigerian Capital Market. The company had applied to the Commission for registration to […]

Circular To All Brokers/Dealers

03/12/2020Rule 56 (1&2) (c) of the Rules and Regulations of the Securities and Exchange Commission provides that: “Registered brokers/dealers shall disclose to the Commission any dealings in a Security valued at a minimum of 500,000 units executed in a single deal or in multiple deals on the same day on behalf of his clients or […]

Pre-Notice On Cancellation/Withdrawal Of Certificates Of Registration Of Inactive Capital Market Operators

10/11/2020The under-listed one hundred and fifty-seven (157) Capital Market Operators (CMOs) were registered by the Securities and Exchange Commission to perform various functions in the Nigerian capital market. However, these CMOs have either consistently failed to render their statutory returns to the Commission, had their capital eroded or were affected by policy changes. In view […]

CIRCULAR – EXTENSION OF DEADLINE TO FILE QUARTERLY FINANCIAL STATEMENTS FOR THE PERIOD ENDING SEPTEMBER 30, 2020

05/11/2020The Securities and Exchange Commission (SEC) has noted the recent general disruption to business operations across the country and the challenges this may have posed on businesses. The SEC is also aware that the disruption to business operations may have prevented public companies, capital market operators and other regulated entities from convening meetings for the […]

CIRCULAR – AUDITED ACCOUNTS OF COLLECTIVE INVESTMENT SCHEMES

22/10/2020Pursuant to the provisions of Section 169(2)&(3) and Section 181(1)(f),(g)&(h) of the Investment and Securities Act 2007, and the importance of disseminating timely information to the market, the Commission shall henceforth discontinue the practice of issuing prior approval or no objection for Audited Accounts of Collective Investment Schemes. Consequently, annual accounts of Collective Investment Schemes […]

CIRCULAR TO ALL CAPITAL MARKET OPERATORS

22/10/2020In line with Section 38(2) of the Investments and Securities Act 2007 which empowers the Securities and Exchange Commission (“the Commission”) to prescribe conditions for registration of capital market operators, including the level of knowledge and skill required to operate in the Nigerian capital market, the Management of the Commission has approved the following: Managing […]

EXPRESSION OF INTEREST ICT TRANSFORMATION – TECHNICAL RESIDENT ADVISOR

16/10/2020Securities and Exchange Commission of Nigeria and FSD Africa are inviting qualified individuals to submit their Expressions of Interest for the role of a Technical Resident Advisor to oversee the development and implementation of an Information Communication and Technology (ICT) Transformation strategy at SEC Nigeria (the “Services”). The consultant will be based at SEC Nigeria […]

Nigeria Commemorates World Investor Week

14/10/2020Nigeria, represented by the Securities and Exchange Commission and other stakeholders, will, in the month of October 2020, join the rest of the world to commemorate the fourth annual World Investor Week (WIW) under the auspices of the International Organisation of Securities Commissions (IOSCO). The WIW is a week-long event aimed at raising awareness […]

SEC Corporate Governance Guideline and Revised FORM 01

10/10/2020Click here to download the template for reporting compliance ( SEC FORM 01) GOVERNANCE GUIDELINES The Financial Reporting Council of Nigeria issued the Nigerian Code of Corporate Governance (NCCG) in 2018, which replaces all existing sectorial Codes of Corporate Governance in Nigeria. The Securities and Exchange Commission subsequently developed the SEC Corporate Governance Guidelines (SCGG). […]

Guidance On The Implementation Of Sections 60 – 63 Of The Investments And Securities Act 2007

22/09/2020In response to the eruption of corporate scandals in 2001 involving financial reporting and accounting practices, several jurisdictions enacted legislations to enhance transparency and uphold the intergrity of financial markets. As part of the efforts to reform corporate financial reporting in Nigeria, the Federal Government of Nigeria passed the amended Investments and Securities Act (ISA), […]

Statement On Digital Assets And Their Classification And Treatment

14/09/2020INTRODUCTION Digital assets offerings provide alternative investment opportunities for the investing public; it is therefore essential to ensure that these offerings operate in a manner that is consistent with investor protection, the interest of the public, market integrity and transparency. The general objective of regulation is not to hinder technology or stifle innovation, but to create standards that encourage ethical practices […]

Re: Activities Of An Illegal Operator IBSmartify Nigeria

26/06/2020The attention of the Commission has been drawn to the activities of iBSmartify Nigeria the promoters of a Blockchain known as iBledger (iBcashcryptocurrency) and InksNation. The general public is hereby advised that neither the promoters of iBSmartify Nigeria nor the illegal products they offer are registered or regulated by the Commission. In view of the […]

New Rules On Collective Investment Schemes

22/06/2020Sequel to the publication of new Rules relating Collective Investment Schemes in December 2019, the Commission hereby issues the following clarifications to facilitate effective compliance with the new CIS Rules. All Fund Managers of Collective Investment Schemes are required to comply with the provisions of the new Rules and file evidence of compliance on or […]

Requirement For Additional Information On All Prospectuses Issued To The Public

18/06/2020This is to inform all stakeholders that as part of efforts to ensure investor protection and promote transparency in the operations of the Nigerian Capital Market, the Commission has introduced a new requirement for inclusion in all prospectuses or offer documents issued to the general public. With effect from the 18th day of June 2020, […]

Official Disclaimer on alleged Resignation of Ms. Mary Uduk as SEC DG

14/06/2020The Securities and Exchange Commission’s (the Commission) attention has been drawn to a publication in the media on sunday June 14, 2020, wherein the Acting Director General, Ms. Mary Uduk is purported to have resigned from the Commission and a send forth party slated for Monday June 15, 2020. The Commission wishes to inform the […]

Circular To All Regulated Entities And The Market – Update On COVID 19

11/05/2020Following the Federal Government’s partial easing of the lockdown measures introduced to minimize the spread of Covid-19 across Nigeria, it has become necessary to provide this update to stakeholders within the Capital Market. The Commission, in compliance with the various guidelines issued by relevant authorities has re-opened its head-office in Abuja. Our office is open […]

The Nigerian Capital Market Community Launches Initiative To Support The Fight Against COVID-19

21/04/2020Following the confirmation of the COVID-19 index case in Nigeria on February 27, 2020 and the subsequent identification of other cases, the Federal and State Governments have introduced several measures to contain the spread of the disease. The private sector has also thrown its weight behind the Government in an effort to contain its spread […]

Guidelines For Issuance Of Fixed Income Securities By Statutory Bodies In WASRA Member Countries

15/04/2020In order to achieve the objective of fostering Capital Market integration in West Africa as embedded in the WASRA Charter, the Executive Council of WASRA in collaboration with the West African Capital Market Integration Council (WACMIC) has prescribed Guidelines for the cross-border issuance of Fixed Income Securities by statutory bodies in WASRA member countries. Download […]

Official Disclaimer On Alleged Recruitment Exercise

13/04/2020The Securities and Exchange Commission’s (the Commission) attention has been drawn to some messages and a video being circulated in the social media, wherein the Commission is alleged to have carried out a recruitment excercise where 811 persons were employed, all from Anambra State with 1 from Kano State. The messages parades the person shown […]

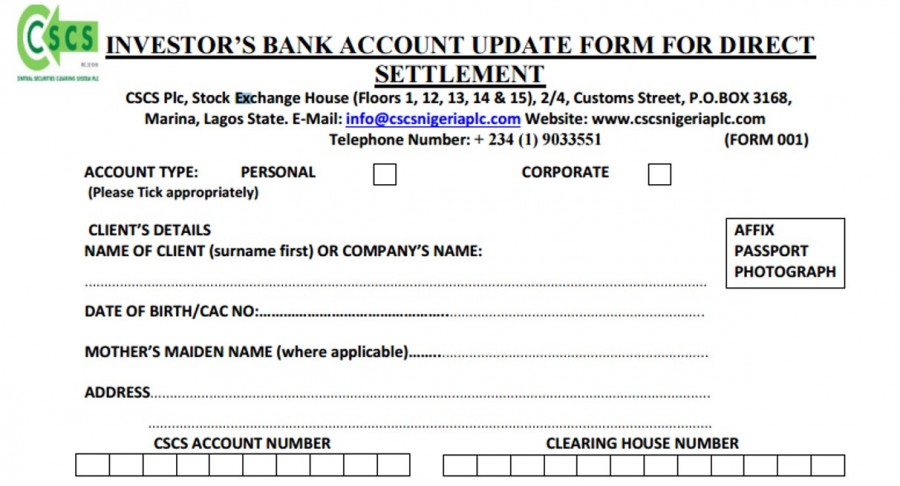

Exposure Of Investor’s Data And Consent Form

06/04/2020The Commission has identified a number of challenges associated with identity management in the Nigerian Capital Market. As part of its efforts to address these challenges, the Commission has developed a standardized Investor’s Data and Consent Form to be adopted by all CMOs in collecting and updating investors’ data. The Form will also enable CMOs […]

Circular To All Regulated Entities And The Market

31/03/2020In light of the global pandemic of the Coronavirus Disease (COVID-19) and in furtherance to the Commission’s circular of March 24, 2020, the Commission wishes to provide additional guidance to the Capital Market as follows: Issuers All public companies are required to continue to make material disclosures to investors on the impact of COVID-19 Pandemic […]

Clarification On Prohibition Of Gifts At General Meetings (AGMS/EGMS)

26/03/2020March 03, 2020 The Securities and Exchange Commission wishes to clarify the application of Rule 602 (4) of its Rules and Regulations. Rule 602(4) states that ‘’public companies shall not distribute gifts to shareholders, observers and any other person at Annual General Meetings/Extra-Ordinary General Meetings’’ The Commission considers it necessary to clarify that ‘’light refreshment’’ […]

Activities Of Unlawful Market Operators

26/03/2020MARCH 11, 2020 The Securities and Exchange Commission wish to draw the attention of the investing public to the activities of unlawful/unlicensed market operators and promoters of other fraudulent schemes. The Commission, in recent time, has observed the proliferation of the operation of unlawful/unlicensed investment schemes, with promises of huge, but unjustifiable returns on investment. […]

Circular To Capital Market Stakeholders On Covid-19

24/03/2020The spread of the Corona Virus (COVID-19) worldwide has created a degree of uncertainty and anxiety, as governments and health experts attempt to curtail the proliferation of the virus. The World Health Organization (WHO) had warned that given Africa’s fragile health systems, the threat posed by COVID-19 in the continent is considerable. This has led […]

Circular to all Capital Market Operators/Stakeholders on Post-Approval Amendments to Transaction Documents

23/03/2020Notice is hereby given to all capital market operators/stakeholders that in addition to the complete filing directive of the Commission, all requests for amendments to Transaction Documents after approval/clearance by the Commission shall attract additional processing fee. All Market Operators/Stakeholders should note that henceforth, any request for a change, alteration, or amendment of documents after […]

2020 Capital Market Committee Meeting Calendar

18/03/2020This is to notify the Capital Market Stakeholders that the 2020 CMC meetings have been scheduled to hold as tabulated below. Schedule Meeting Dates First CMC April 23rd, 2020 Second CMC July 23rd, 2020 Third CMC November 19th, 2020 This is to enable adequate planning and logistics before the meeting dates and to ensure […]

International Conference on the Nigerian Commodities Market 16-17 March 2020

14/03/2020The Securities and Exchange Commission in collaboration with the Implementation Committee on the Commodities Trading Ecosystem Roadmap, invites you to the inaugural International Conference on the Nigerian Commodities Market with the theme: Commodities Trading Ecosystem: Key to diversifying the Nigerian Economy. Dates: March 16-17, 2020 Venue: Congress Hall, Transcorp Hilton Hotel, Abuja For more information, […]

Maintaining And Updating Comprehensive Investors/Shareholders Account Information

13/03/2020The Securities and Exchange Commission (the Commission) in furtherance of its investor protection and market development mandate has over the years, and in collaboration with other market stakeholders, worked actively to –amongst others – ensure accountability, transparency and stability in the capital market. In line with the foregoing, the Commission desires to forestall, reduce and […]

Communique Issued At The 2020 Budget Seminar Themed “Leveraging The 2020 Budget And The Finance Act For The Growth Of The Nigerian Capital Market”

13/03/202013th February 2020 Lagos Download PDF 1. The Budget Seminar Series is a forum for evaluating the nexus between the Nigerian capital market and the annual Federal Government budget. Its major aim is to identify how the capital market can contribute, and in turn, benefit from the budget and its implementation. 2. In addition to […]

Ban On Six (6) Online Brokers By Italian Financial Authorities

09/03/2020The attention of the Securities and Exchange Commission (the Commission) has been drawn to the public notice by the Italian securities regulator, Commissione Nazionale per le Società e la Borsa (CONSOB) on six (6) online forex brokers who engage in “unlawful” and “misleading” Forex and other retail products marketing practices and financial services. The online brokers and […]

Securities And Exchange Commission’s 4th Budget Seminar

07/02/2020The Commission will hold its 4th Budget Seminar Series with the theme, “Leveraging the 2020 Budget and Finance Act for the Growth of the Nigerian Capital Market” on Thursday, 13th February, 2020 at the Grand Ball Room, Eko Hotels and Suites, Plot 1415, Adetokunbo Ademola Street, Victoria Island, Lagos at 10:00 am. The Seminar […]

Training Programme For Capital Market Operators and Compliance Officers

07/02/202004/02/2020 The Securities and Exchange Commission is organizing a training programme for Capital Market Operators and Compliance Officers: Date: March 11 and 12, 2020 Venue: SEC Lagos Zonal Office, 3, Idejo Street, Victoria Island, Lagos Time: 9.00 am daily Course fee: N50,000 The training would cover topics such as Overview of the Financial […]

Public Notice – Penalties and Ban Expiration – Adekunle Alli

29/01/2020Sequel to the Commission’s APC decision in respect of BGL Group in APC/1/2015: RIVERS STATE MINISTRY OF FINANCE & 31 OTHERS V. BGL PLC & 31 OTHERS and APC/1/2016: AFOLABI GABRIEL OLUWASEYI & 9 OTHERS V. BGL SECURITIES LTD & 22 OTHERS, the Commission hereby informs the general public of the expiration of penalties/ban issued on […]

Operations Of Nominee Accounts By Capital Market Operators

28/10/2019Following the amendment of Rule 61 (2) of the Consolidated SEC Rules and Regulations 2013 on the Regulation of Nominee Accounts, the Commission hereby issues the under listed directives to facilitate effective compliance with the Rules. a) A Capital Market Operator (CMO) who wishes to operate nominee accounts shall apply to the Commission and […]

BGL Group APC Decision

05/10/2019Sequel to the Commission’s APC decision in respect of BGL Group in APC/1/2015: RIVERS STATE MINISTRY OF FINANCE & 31 OTHERS V. BGL PLC & 31 OTHERS and APC/1/2016: AFOLABI GABRIEL OLUWASEYI & 9 OTHERS V. BGL SECURITIES LTD & 22 OTHERS, the Commission hereby informs the general public of the expiration of penalties/ban issued on the following […]

Reduction Of Exemption Fees For Some Capital Market Experts

13/09/2019You may wish to recall that Capital Market Professionals with a minimum of 15 years relevant post-qualification experience with not more than 2 years interruption, who have attained their heights were approved to be exempted from the Pre-Registration workshop/examination subject to the attendance of a mandatory Executive course. Further to the earlier circular on the […]

Unclaimed Dividends Of Defunct Afribank Plc

11/09/2019The Securities and Exchange Commission (“The Commission”) wishes to inform shareholders of the defunct Afribank Plc that unclaimed dividends by the bank are being held in trust on their behalf. Investors that have unclaimed dividends are therefore advised to contact Carnation Registrars to process their dividends for payment. The Commission has also directed Carnation Registrars […]

Dantata Success and Profitable Company – Notice of Commencement of Verification of Claims of Unpaid Investors

15/07/2019Dantata Success and Profitable Company (A Registered Business Name with Registration Number BN 2627640 Notice of Commencement of Verification of Claims of Unpaid Investors Date: 10th July,2019 Sequel to the appointment of joint Administrators/Trustees for Dantata Success and Profitable Company by the Securities and Exchange Commission (SEC) pursuant to section 13 and 173 of the Investment […]

CMOS Without Managing Directors And Compliance Officers

27/06/2019The attention of the Securities and Exchange Commission (“the Commission“) has been drawn to the recent trend by which CMOs carry on operations without Compliance Officers and Managing Directors, in violation of the SEC Rules and Regulations. CMOs are hereby reminded that pursuant to Rule 14 of the SEC Rules and Regulations and the amendments […]

RE: Cross-Reference Checklist Review

10/06/2019The general public is hereby notified that the Commission commenced the Cross-Reference Checklist Review of Bond/fixed income applications with effect from June 1, 2019. Consequently, a duly filled Cross-Reference Checklist is required to be filed along with the relevant applications. The Cross-Reference Checklist Review is intended run for six (6) months and is a precursor […]

Press Release On Suspension Of The Annual General Meeting Of Oando Plc

10/06/2019The Securities & Exchange Commission (‘the Commission’) hereby notifies the public that further to the Ex-parte Order of the Federal High Court, Ikoyi Lagos in Suit No: FHC/L/Cs/910/19 In Mr. Jubril Adewale Tinubu & Anor V Securities & Exchange Commission & Anor, the Annual General Meeting of Oando Plc (a company listed on the Nigerian […]

Investigation Of Oando Plc

09/06/2019June 7, 2019 The attention of the SEC has been drawn to various reports questioning the regulatory authority of the SEC, and insinuating lack of due process in the investigations of Oando Plc. To put the records straight, the SEC hereby states as follows: 1. Fair hearing is a paramount and fundamental principle, which the […]

Unethical Practice Of Commission Sharing By Brokers, Issuing Houses/Bookrunners And Other Receiving Agents

27/05/2019The attention of the Securities and Exchange Commission (the Commission) has been drawn to an emerging trend of unethical conduct by Brokers, Issuing Houses/Book Runners and other Receiving Agents in primary and secondary market transactions by inducing investment through the sharing of brokerage fees or receiving agents commission with private banking officers, asset/fund managers, PFA’s […]

SEC, NSE Streamline Listing Process to Encourage More Listings

23/05/2019Lagos, May 23, 2019. The Securities and Exchange Commission (SEC) and the Nigerian Stock Exchange (“The Exchange” or “NSE”) have moved to make the processes involving listing on the NSE more efficient and cost effective by streamlining the approval process between the SEC and the NSE. The streamlined process which will come into effect on […]

Public Notice On Dantata Success And Profitable Company

08/05/2019The Securities and Exchange Commission (the Commission), pursuant to its powers under section 13(w) of the Investments and Securities Act 2007, on 6th February 2019 sealed up the business premises of Dantata Success and Profitable Company (DSPC). The company has been involved in unlawful solicitation of funds from the public with a promise of inexplicable […]

Re: Extension Of Deadline On Issuance Of Dividend Warrants And Free E-Dividend Registration Exercise

28/03/2019We refer to the circular dated 29thJune 2017 issued by the Securities and Exchange Commission (“the Commission”) on the above subject matter. The Commission recently conducted a strategic assessment of the implementation of the e-dividend initiative across the country and reviewed feedback/observations received from stakeholders and the general public. The assessment revealed that while remarkable progress […]

Public Notice On Growing Circle International (G – Circle)

18/03/2019Following information received by the Securities and Exchange Commission (the Commission) from a member of the public, surveillance was conducted on the activities of Growing Circle International (“G-Circle) whose head office is No 6 Mojidi Street, off Toyin Street, Ikeja Lagos. The Commission’s investigation revealed that G-Circle was operating a pyramid scheme and soliciting funds […]

Capital Market Committee Meeting March 2019

12/03/2019The Securities and Exchange Commission hereby informs stakeholders of the following event EVENT: CAPITAL MARKET COMMITTEE MEETING (CMC) DATE: Thursday March 21, 2019 VENUE: Orchid Hall, Eko Hotels and Suites, Victoria Island, Lagos TIME: 10.00am Please note that attendance is strictly on invitation and members are implored to come with their CMC ID Card

Budget Seminar 2019

12/03/2019The Securities and Exchange Commission hereby informs stakeholders and the general public of the following event DATE: Tuesday March 19, 2019 VENUE: Grand Ball Room, Eko Hotels and Suites, Victoria Island, Lagos TIME: 10.00am

The Court Of Appeal Decision In Securities And Exchange Commission Vs. Big Treat Plc & 5 Others Reaffirms The Commission’s Regulatory Oversight Over Public Companies In Nigeria

12/03/2019In 2008, the Securities and Exchange Commission (the Commission), conducted an investigation on Big Treat Plc a public listed company (1stRespondent) and its directors which revealed several infractions of the Investments and Securities Act 2007 such as inadequate internal control systems and a breakdown of corporate governance in the company. Based on the foregoing, and […]

Illegal fund manager – Dantata Success and Profitable Company

25/02/2019The Securities and Exchange Commission (the Commission) pursuant to its powers under Section 13 (w) of the Investments and Securities Act (ISA), 2007, on 6 February 2019 sealed up the business premises of Dantata Success & Profitable Company (DSPC), a company that had been engaging in illegal activities in the Nigerian capital market. In addition, […]

Notification for First Capital Market Committee Meeting In 2019

08/02/2019The First Capital Market Committee (CMC) Meeting in 2019 has been scheduled to hold on Thursday, 21stMarch, 2019 at the Eko Hotels & Suites, Orchid Hall, 1415 Adetokunbo Ademola Street, Victoria Island, Lagos. The usual interface with members of the press will hold the following day being Friday, 22ndMarch, 2019 at the SEC Lagos Zonal Office, 3, Idejo Street, […]

Notice on the Passage of the Federal Competition and Consumer Protection Act

08/02/2019On Tuesday, February 5, 2019, President Muhammadu Buhari signed the Federal Competition and Consumer Protection Act into law. The Law which seeks to, among other things, provide for the establishment of the Federal Competition and Consumer Protection Commission and the Competition and Consumer Protection Tribunal, also repeals the sections 118, 119, 120, 121 (excluding S. […]

Fidelity Bond for the year 2019

18/01/2019By virtue of Rule 27 (1) of SEC Rules and Regulations, (made pursuant to the Investments and Securities Act, 2007) every Registered CMO, as defined in the Act, is required to provide and maintaina Bond or Professional Indemnity Insurance Policy. In view of the foregoing, all registered Capital Market Operators who have not updated their […]

The Securities And Exchange Commision (SEC) Nigeria Launches Green Bond Rules

03/12/2018ABUJA: 03/12/18:The Securities and Exchange Commission of Nigeria (“SEC”) officially launched the Green Bonds Issuance Rules at a ceremony yesterday. Following a series of engagements with stakeholders and Capital Market Operators, the SEC rolled out its rules on Green Bonds on October 12, 2018. The SEC has collaborated on several occasions with the Green […]

Introduction of the Interpretive Guidance Note (IGN)

14/11/2018The public and all capital market stakeholders are informed of the introduction of the Commission’s Interpretive Guidance Note (IGN). The IGN would assist in the understanding of; provide guidance in compliance with the Investment Securities Act (ISA), SEC Rules and Regulations and other issues within the Commission’s regulatory purview. >>Click here to access the IGN<<

Notification For Third CMC Meeting In 2018

19/10/2018The Third Capital Market Committee (CMC) Meeting in 2018 has been scheduled to hold on Wednesday, 14th November, 2018 at the Federal Palace Hotel, Victoria Island, Lagos. The usual interface with members of the press will hold the following day being Thursday, 15th November, 2018 at the SEC Lagos Zonal Office, 3, Idejo Street, Victoria Island, Lagos. Attendance to both […]

New Rule And Sundry Amendments To The Rules And Regulations Of The Commission

19/10/2018SUMMARY OF CHANGES New rule (1) Rules on Green Bonds Sundry Amendments (1) Inclusion of BVN as a valid means of identification of individual clients in the Capital Market (2) Rule on Investment Advisory Services (3) Amendment to Rule 61- Nominee Accounts (4) Amendment to Rule 96 & 97- Investment Advisers GREEN BONDS 1.0 […]

Public Notice: Online Retail Foreign Exchange (Forex) Trading

19/10/2018The attention of the Securities and Exchange Commission (SEC) has been drawn to the increased advertisements in electronic and other media soliciting investors to engage in leveraged online retail forex trading. The public is hereby advised that online retail forex trading is currently unregulated and consequently may be subject to abuse. Until a […]

Mandatory Registration Of All Capital Market Operators With Their Respective Trade Groups/Associations

10/10/2018The Commission hereby draws the attention of all Capital Market Operators to Rule 25(1)(a) of the SEC Rules and Regulations (as amended) on Membership of Self-Regulatory Organizations (SROs). The Rule provides that “Every person registered to perform any function in the market shall be a member of an SRO or a Trade Association relevant to […]

Notice of Capital Market Stakeholders’ Forum