Welcome

Welcome to FinPort, the SEC’s Portal where innovations and Financial Technology (FinTech) are encouraged and facilitated. The SEC believes that the driver to transforming Nigeria into a smart financial centre is the provision of a regulatory environment that is conducive for innovative use of technology. FinPort has been established to assist all new and even existing Financial Technology (FinTech) businesses to understand the regulatory demands or requirements relevant to the Nigerian capital market.

Click to access – The Regulatory Incubation Program Portal

The Securities and Exchange Commission Nigeria as the apex regulator of the Nigerian Capital Market, is empowered by the Investment and Securities Act 2007 to regulate and develop the Nigerian Capital to ensure fairness, integrity, ease and freedom of participation (entry & exit). In that light, the SEC is always fully alert in tracking new developments in the financial markets in general and the Capital Market in particular. The evident preponderance in the Nigerian Financial Markets as in other global markets, of new innovations aimed at enhancing financial products and services through the application and utilization of technology tools among others, necessitates the creation and adoption of adequate processes and tools to satisfactorily deliver on the Commission’s mandate.

The financial innovation landscape as agreed by all, is an evolving one. The Commission like regulators all over the world, is prepared to evolve with it. It has put mechanisms in place to understand these new innovations, build required capacity and subsequently deploy strategies to address them. This process is an ongoing one and the Commission is deeply committed to this new phase and face of our Capital Market.

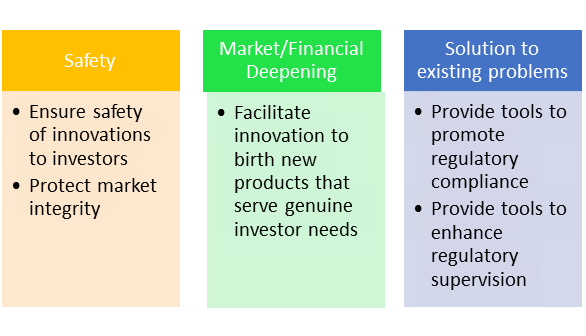

In the Commission’s resolve to facilitate innovation in the Nigerian Capital Market, it has articulated and adopted a three-pronged objective to regulate innovation. While it is both accommodating and futuristic, it also ensures adherence to our regulatory mandate and aims to provide confidence to all stakeholders. This objective hinged on safety, market deepening and solution to problems as outlined below, will guide our strategy, our regulations and our interaction with innovators seeking legitimacy and relevance, thereby creating value in the Nigerian Capital Market.

Three-pronged Objective to Regulate Innovation in the Nigerian Capital Market

Indeed SEC Nigeria is committed to a journey whose destination though uncertain will undoubtedly experience different turns, several weather conditions and diverse vehicles. All stakeholders are urged to come on board and commit to developing a Capital Market that will contribute in a more resounding way, to the economic development of our Nigeria.

The Commission’s Regulatory Incubation (RI) program is designed to address the needs of new business models and processes that require regulatory authorization to continue carrying out full or ancillary technology-driven Capital Market activities. It is conceived as an interim measure to aid the evolution of effective regulation which accommodates innovation by FinTechs without compromising market integrity and within limits that ensure investor protection.

The RI Program was launched in April, 2023 and operates by admitting identified Fintech business models and processes in cohorts for a one-year period. Participation in the RI program encompasses an Initial Assessment Phase and the Regulatory Incubation Phase. The categories considered for admission into each cohort is determined based on submissions received through the Initial Assessment Form and communicated ahead of each take-off date.

FinTechs who consider that there is no specific regulation governing their business models or who require clarity on the appropriate regulatory regime for seeking the authorisation of the Commission, are encouraged to complete the Initial Assessment Form.

Information on the RI Program:

FinTech Related Rules & Regulations

Draft Rules & Regulations

Registered FinTech Operators

| Crowdfunding | Robo Adviser | Digital Sub-Broker | Digital Investment (Fund/Portfolio) Manager |

| Obelix 4.1.1 Alternative Ltd | Wahed Ltd | Chaka Technologies Ltd | Cowrywise Financial Technology Ltd |

| PropCrowdy Ltd | Bamboo System Technology | ||

| Pennytree Business ltd | Treager Integrated Services Ltd | ||

| Magnacap Ltd |

Frequently Ask Questions (FAQs)

Reports & Releases

- Proposed Major Amendment to the Rules on Issuance, Offering Platforms and Custody of Digital Assets

- The SEC Regulatory Incubation Program: Call for Applications into Cohort 002/24

- Notice of Acceptance of Applications for the Regulatory Incubation (RI) Program

- Circular on the SEC Regulatory Incubation Program

- Regulatory Incubation Guidelines

- Press Release on Cryptocurrencies

- Report of the FinTech Roadmap Committee of the Nigerian Capital Market

- SEC Classification of Virtual & Digital Assets and their Treatment

Collaborations

- The Global Financial Innovation Network (GFIN)

- The Cambridge Centre for Alternative Finance(CCAF)

- IOSCO FinTech Network

Contact Innovation Office

1. Via e-mail: innovation@sec.gov.ng; fintech@sec.gov.ng

2. Via Telephone: +234(209) 46211168 (Ext. 1277, 1405), +234(209)46211277

3. Visit the Innovation Office on 2nd Floor, SEC Tower, Abuja (Tuesdays – 10.00a.m – 2.30p.m)

4. Via this Form: